Independent contractors often face unique challenges when it comes to managing their finances, especially in tracking their income and expenses. Unlike traditional employees, independent contractors receive a 1099 form (aka contractor pay stub) instead of a W-2, and their paystubs reflect this difference.

This blog explores the ins and outs of 1099 pay stubs for contractors, including what they are, how to handle them, and why using a reliable pay stub generator like CheckStubGenerator.com can make the process seamless and efficient.

What is a 1099 employee pay stub?

A 1099 check stub is a document provided to independent contractors that outlines their earnings and deductions for a specific pay period. Unlike traditional employees, 1099 workers are not subject to automatic tax withholdings, and they must manage their tax payments. The contractor pay stubs help in tracking income, and ensuring accurate records for tax filing and financial planning.

Simple ways for managing pay stubs for 1099 Independent Contractors Perfectly!

Handling pay stubs for 1099 independent contractors involves several key steps:

1. Accurate Record-Keeping: Maintain detailed records of all payments received. This includes the date, amount, and any relevant notes about the work performed.

2. Expense Tracking: Keep track of business-related expenses to ensure they are accurately deducted from taxable income.

3. Prefer regular updates: It’s best to keep your financial records updated by creating paychecks regularly so that last-minute stress is avoided.

4. Consult a professional: If you are unable to manage everything by yourself, outsource your financial management to a tax professional. This will ensure compliance with tax laws and minimize hassles at your end.

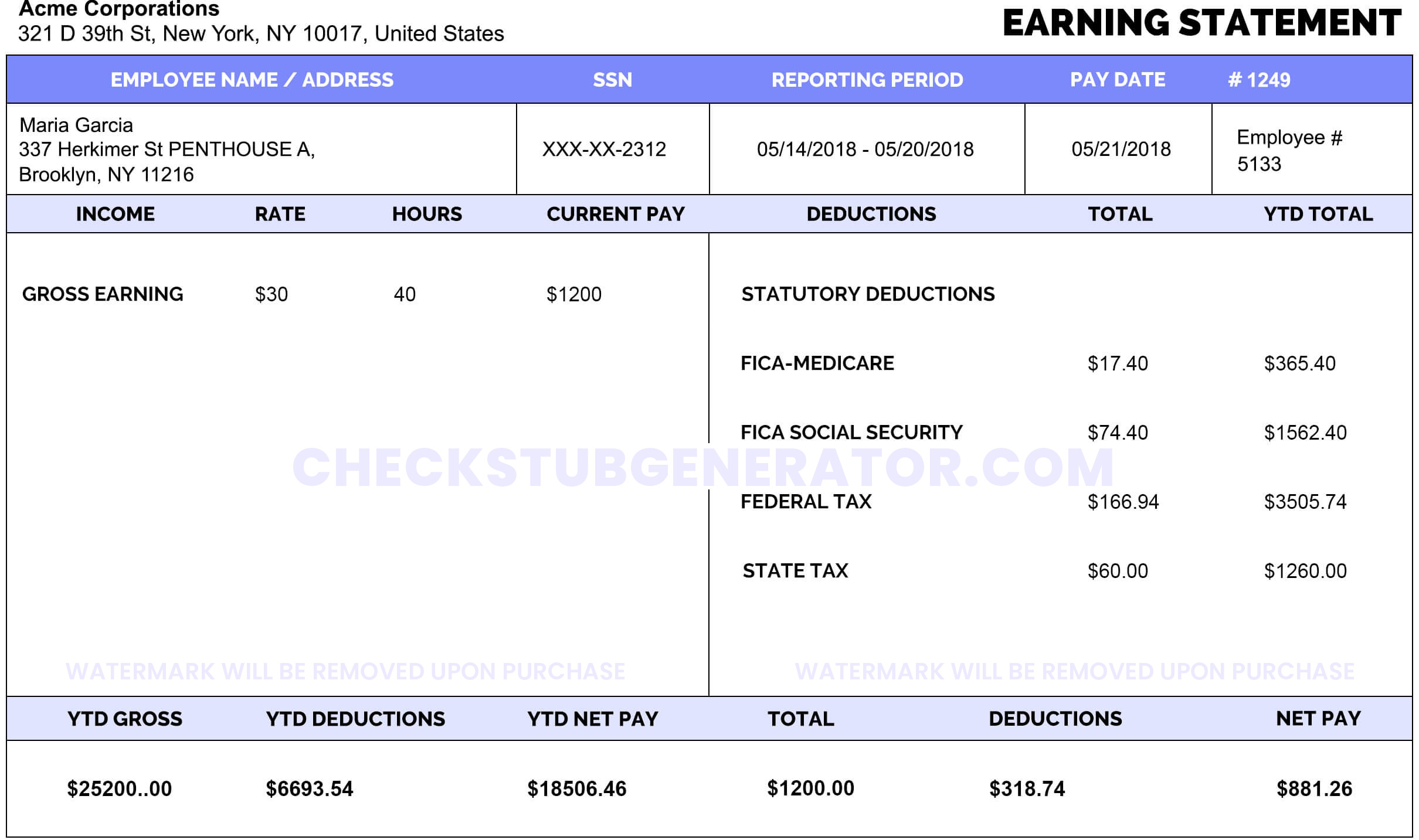

1099 Independent Contractor Pay Stub Template – What does it look like?

As you can see, the pay stub templates for salaried employees and independent contractors have minor differences. The deductions are never regarding taxes or withholdings here.

A Breakdown of the information it contains

The template is almost similar for independent contractors with most paystub makers free. Typically, it includes the following sections:

Contractor Details: Name of the contractor, their address, and contact details respectively.

Company Information: Name, address, and contact details of the hiring company.

Earnings: Detailed breakdown of earnings for the pay period.

Deductions: Any deductions made, such as equipment costs or supplies.

Net Pay: Total earnings after deductions.

Steps for Using independent contractor 1099 pay stub template

As you proceed with our tool, you’ll access the 1099 paystub template as follows:

1. Enter Contractor Details: Fill in your personal information, including name and address.

2. Enter Company Details: Add the details of the company you are working for.

3. Input Earnings and Deductions: Accurately enter the Year-to-Date (YTD) amounts earned and any deductions made during the pay period.

4. Review and Save: Double-check all the entered information for accuracy and save the document.

5. Generate and Distribute: Generate a pay stub and distribute it to the relevant parties, keeping a copy for your records.

Why choose checkstubgenerator.com for your Independent Contractor pay stub?

Choosing us for your independent contractor check paystub will drive several benefits:

User-Friendly Interface: Easy-to-use platform that simplifies the creation of pay stubs.

Customizable Templates: Wide range of customizable templates to suit your specific needs.

Automated Calculations: Automation ensures accuracy and compliance with regulations comes default. You can’t even imagine how convenient it is to manage payroll with such precision.

Secure and Confidential: Ensures your financial information is kept secure and confidential.

24/7 Support: We offer unbreakable customer assistance regardless of the queries or concerns you have for the pay stubs.

Summary

Managing finances as an independent contractor can be challenging, but having accurate and detailed pay stubs is essential for tracking income and preparing for tax season. Understanding what a 1099 pay stub is, how to handle it, and using a reliable 1099 pay stub generator like checkstubgenerator.com can simplify the process.

By following the steps outlined and using a professional service, you can ensure your financial records are accurate, secure, and ready for any financial needs that arise.

Head over to our check stub generator now!

FAQs

1. Why do Independent Contractors need a pay stub?

Just like any salaried employees, independent contractors can make use of pay stubs as their evidence of income. With checkstubgenerator.com, you can create check stubs for contractors in a few minutes by filling in some basic details.

2.Is it possible to add earnings or certain deductions to contractor check stubs?

Yes, you can add earnings or any specific deductions to the contractor check stubs, if required. With checkstubgenerator.com, it is convenient to add additional earnings besides the nonemployee compensation.

3. Can I use any paystub template for contractors as I like?

Sure! Feel free to use any of the pay stub templates you wish to use for your contractor pay stubs. Check stub generator has numerous professional template designs to choose from. Explore now!

Create your stub now